The Ultimate Guide to Business Loans

Business Loans

UPDATED ON 2024

10 MIN READ

Types of Business Loans

Business loans are essential financing options for small and large businesses to grow, expand, or even maintain their operations. There are several types of small business financing and loans available in the market, each with its unique features and requirements. Understanding the types of loans for small businesses is important in order to choose the most suitable financing option for a business's specific needs. In this section, we will explore the most common types of small business loans used, including secured loans, unsecured loans, term loans, lines of credit, equipment loans, invoice financing, and SBA loans.

Secured Loans

Secured loans require collateral to secure the loan, such as property, equipment, or inventory. The collateral provides a lender with security in case a borrower defaults on the loan. As a result, secured loans are less risky for lenders and have competitive interest rates compared to unsecured loans. However, the borrower risks losing their collateral if they fail to repay the loan.

Secured loans are ideal for businesses that need significant financing, such as purchasing real estate or equipment. They are also suitable for businesses that have a limited credit history or a low credit score. The loan amount and interest rate depend on the collateral's value, the borrower's creditworthiness, and the lender's terms and conditions.

Unsecured Loans

Unsecured loans do not require collateral to secure the loan, making them riskier for lenders. As a result, this small business loan has higher interest rates than secured loans. However, they are ideal for businesses that cannot provide collateral or do not want to risk their assets.

Unsecured loans are suitable for small businesses that need financing for short-term business needs, such as working capital or inventory. They are also suitable long term loans for businesses with an established credit history or a high credit score. The amount and interest rate depend on the borrower's creditworthiness, income, and repayment history.

Term Loans

Term loans are a type of loan that provides a lump sum of money that the borrower must repay over a set period. The repayment period typically ranges from one to ten years, depending on the amount of the loan and the lender's terms and conditions. Term loans are good for businesses that need financing for long-term investments, such as purchasing equipment or real estate.

Term loans can be secured or unsecured, and the interest rates depend on the amount of loan requested, repayment period, and the borrower's creditworthiness. The borrower must make regular payments, including principal and interest, until the loan is fully repaid.

Lines of Credit

Lines of credit are a type of revolving credit that allows businesses to access a pre-approved amount of funds whenever they need them. The borrower only pays interest on the amount that they use, making business lines of credit ideal for short-term financing needs. Lines of credit can be secured or unsecured, and the interest rates depend on the borrower's creditworthiness and the lender's terms and conditions.

Lines of credit are suitable for businesses that need flexible financing options, such as covering cash flow gaps or unexpected expenses. They are also suitable for businesses that have seasonal fluctuations in revenue or need to finance short-term projects.

Equipment Loans

Equipment loans are a type of secured loan that provides financing to purchase equipment or machinery for a business. The equipment serves as collateral for the loan, making this small business loan less risky for lenders. Equipment loans typically have competitive interest rates and longer repayment periods than other types of secured loans.

Equipment loans are suitable for businesses that need to purchase expensive equipment or machinery, such as construction companies or manufacturing businesses. The loan amount and interest rate depend on the equipment's value, the borrower's creditworthiness, and the lender's terms and conditions. Equipment loans may also require a down payment or a percentage of the equipment's value as a deposit.

Equipment loans may offer several benefits to businesses, such as improving efficiency, reducing downtime, and increasing productivity. With equipment financing, businesses can acquire the latest technology and equipment without the need for a large upfront investment.

Invoice Financing

Invoice financing is a type of short-term financing that provides businesses with immediate cash flow by using unpaid invoices as collateral. The lender pays the business a percentage of the invoice amount, usually ranging from 80% to 90%, and collects the payment from the customer when the invoice is due. Once the customer pays the invoice, the lender pays the remaining amount to the business, minus the lender's fees.

Invoice financing is suitable for businesses that have a high volume of outstanding invoices or customers with a longer payment cycle. Invoice financing can help businesses improve their cash flow, cover short-term expenses, and avoid the need for expensive debt or equity financing.

SBA Loans

SBA loans are a type of government-guaranteed loan program that provides financing to small businesses. The Small Business Administration (SBA) guarantees a portion of the loan amount, making it less risky for lenders to provide financing to small businesses. SBA lenders offer lower interest rates, longer repayment periods, and flexible terms compared to other types of loans.

SBA loans are suitable for businesses that need financing for long-term investments, such as purchasing real estate or expanding their operations. SBA loans are also suitable for startups or businesses with limited credit history or a low credit score. The loan amount and interest rate depend on the business's size, industry, financial performance, and the lender's terms and conditions.

How to Get a Business Loan

One of the most critical factors that lenders consider when evaluating a business loan application is the borrower's credit score and credit history. A credit score is a numerical representation of a borrower's creditworthiness, based on their past credit history, debt-to-income ratio, and other financial factors. A higher credit score indicates a lower risk of default and is more likely to be approved for a loan.

Before applying for a loan, it is essential to review and understand your credit score and credit history.

You can work on improving your credit score by paying bills on time, reducing debt, and correcting errors in your credit report.

Time in Business

Another important factor that lenders consider when evaluating a loan application is the borrower's time in business. Lenders prefer businesses that have been operating for at least a couple of years, as they have a proven track record of generating revenue and managing their finances. Of course, some lenders may consider newer businesses if they have a strong business plan and financial projections, so it's not a be-all-end-all situation.

Annual Revenue and Profitability

Lenders also consider a business's annual revenue and profitability when considering whether or not to provide financing. Businesses with higher revenue and profitability have a better chance of securing a loan as they demonstrate the ability to repay the loan.

Lenders may also evaluate a business's debt-to-income ratio, which is a measure of the amount of debt compared to income. A high debt-to-income ratio may indicate a high risk of default, potentially making it more difficult to secure a loan.

Collateral

Collateral is an asset that a borrower pledges as security for a loan. Lenders may require collateral to reduce their risk of lending to a business. Collateral can be in the form of property, equipment, inventory, or accounts receivable.

The amount and type of collateral required may depend on the loan amount and the borrower's creditworthiness. It is essential to understand the terms and conditions of the loan agreement and the risks associated with pledging collateral.

Business Plan

A business plan is a written document that outlines a business's objectives, strategies, and financial projections. Lenders may require a business plan to evaluate the borrower's ability to manage their finances and generate revenue.

A well-written business plan can increase the chances of securing a loan and demonstrate the borrower's understanding of their own business idea and the market. It is essential to include realistic financial projections and a repayment plan in the business plan.

Choosing the Right Business Loan

The Benefits of Having a Separate Bank Account for Your Business

Opening a business bank account is essential for managing your business finances effectively. It provides a separate space to manage your business funds, transactions, and expenses, which helps in keeping your personal finances separate from your business finances.

Some benefits of having a separate bank account for your business include:

Easier bookkeeping: A business bank account helps in keeping your business transactions separate from personal ones, which makes bookkeeping easier. This means you won't have to sort through personal transactions when preparing your business's financial statements, tax returns, or applying for a loan.

- Professional image: A business bank account helps in building a professional image and credibility. It shows you are serious about your business and committed to responsibly managing your finances.

- Payment processing: A business bank account makes it easier to process payments from clients and pay vendors. You can receive payments through checks, electronic transfers, or credit card payments, making it easier to manage cash flow.

- Access to banking services: A business bank account provides access to a whole range of services, such as credit cards, lines of credit, and loans, which can help you manage cash flow, expand your business, and fund growth.

Legal and Tax Implications of Commingling Personal and Business Funds

Commingling personal and business funds can have legal and tax implications. It can lead to legal issues if a business owner is sued, as personal assets may be at risk. Additionally, commingling funds can make it difficult to track business expenses for tax purposes, potentially leading to incorrect tax filings and penalties.

How a Business Bank Account Can Help You Manage Your Finances and Track Your Business's Performance

A business bank account can help you manage your finances by providing tools to track cash flow, manage expenses, and reconcile accounts. You can also use a business bank account to create a budget, set financial goals, and monitor your business's performance. By tracking your business's financial performance, you can make informed decisions, identify areas of improvement, and plan for growth. Additionally, a bank account for business provides access to financial statements and transaction records, which can be used to apply for loans, prepare tax returns, and analyze financial trends.

Applying for a Business Loan

If your business needs financing, applying for a business loan can be an effective way to obtain the necessary funds. The application process for a loan may seem intimidating, but understanding the steps involved can help make the process smoother. In this section, we will discuss the steps to applying for a business loan.

Step 1: Gathering Required Documents

The first step in the loan application process is gathering the required documents. Lenders typically require specific documents to assess your business's financial health and creditworthiness. These documents may include your business plan, tax returns, financial statements, bank statements, and legal documents such as business licenses and contracts.

Before you start the application process, ensure that you have all the required documents in order. This will help expedite the application process and increase the likelihood of approval.

Step 2: Completing the Loan Application

Once you have gathered all the necessary documents, the next step is to complete the loan application. The application will typically require information about your business, including its legal structure, industry, and revenue. You may also need to provide personal information, such as your credit score and history.

It is essential to be thorough and accurate when completing the application to increase the likelihood of approval. If you have any questions or concerns, do not hesitate to contact the lender for clarification.

Step 3: Waiting for Approval

After completing the loan application, the next step is to wait for the approval. The time it takes for approval may vary depending on the lender and loan type. Some lenders may provide a decision within a few days, while others may take several weeks.

During this waiting period, the lender may request additional documentation or clarification. It is really important to be available to respond promptly to any requests to avoid delays in the approval process.

By gathering the required documents, completing the loan application accurately, and waiting for approval, you can increase the likelihood of obtaining the financing your business needs.

Alternatives to Business Loans

While a loan can be an excellent source of financing for small businesses, they are not always the best option. Depending on your business's needs and circumstances, you may want to consider alternative funding options.

Business Grants

Business grants are an excellent alternative to business loans for entrepreneurs who do not want to incur debt. Unlike loans, grants do not need to be repaid. Business grants are typically provided by the government, private foundations, or non-profit organizations to support specific business activities, such as research and development or hiring employees.

The application process for business grants is typically more rigorous than for loans, as the funding is limited and highly competitive. However, if your business meets the eligibility criteria, a grant can provide a significant financial boost.

Crowdfunding

Crowdfunding is another alternative funding option that has become increasingly popular in recent years. With crowdfunding, businesses can raise funds from a large number of individuals through online platforms.

Crowdfunding can be an effective way to obtain financing for business purposes while also building a customer base and increasing brand awareness. However, it requires a significant amount of effort and time to create a successful crowdfunding campaign.

Angel Investors and Venture Capitalists

Angel investors and venture capitalists are individuals or companies that invest in startups and early-stage businesses. They typically provide funding in exchange for equity in the company.

While angel investors and venture capitalists can provide significant funding, they also expect a high return on their investment. They may also require a significant say in the business's operations and decision-making.

Personal Savings and Credit

It is also possible to use personal savings and credit. This option is ideal for entrepreneurs who have a significant amount of personal savings or a good credit score.

Using personal savings and credit can be a convenient option, as there is no application process or approval required. However, it also comes with risks, as using personal funds to finance a business can put personal assets at risk.

Tips for Getting Approved for a Business Loan

Getting approved for a business loan can be a bit of a challenging process, especially if you are a small business owner. However, there are several things you can do to increase your chances of approval. In this section, we will discuss some tips for getting approved for a loan.

Improve Your Credit Score

Your credit score is one of the most critical factors that lenders consider when evaluating your loan application. If your credit score is low, you may have difficulty getting approved for a loan or may be offered a higher interest rate

Build Strong Business Relationships

Having strong business relationships can also increase your chances of getting approved for a loan. Lenders are more likely to approve loan applications from businesses with a good reputation in their industry.

To build strong business relationships, attend networking events, join industry associations, and participate in local business groups.

Present a Solid Business Plan

Having a solid business plan is essential when applying for a business loan. Your business plan should outline your company's goals, financial projections, and how you plan to use the loan funds.

A well-written business plan can demonstrate to lenders that you have a clear understanding of your business's financial needs and can repay the loan.

Use Collateral if Possible

Collateral is something of value that you pledge as security for the loan. If you default on the loan, the lender can seize the collateral to repay the debt.

Using collateral can increase your chances of getting approved for a loan and may also result in a lower interest rate. However, using collateral also means that you are putting your business assets at risk.

Compare Loan Offers from Different Lenders

It is also essential to compare loan offers from different lenders before applying. Lenders offer loans with different interest rates, fees, and repayment terms, so it is crucial to shop around to find the best deal.

Comparing loan offers can help you find a loan that fits your business's needs and budget, while also ensuring that you are getting a fair deal.

Types of Businesses that May Need Loans

Business loans can be a useful tool for many different types of businesses. In this section, we will discuss some of the best small business loans and the types of businesses that may need loans to support their operations.

Startups

Startups are newly formed businesses that are often in need of capital to get their operations off the ground. They may need funding for equipment, office space, inventory, and other startup costs.

Loans can be an excellent source of funding for startups, allowing them to launch their business and start generating revenue.

Small Businesses

Small businesses are the backbone of the economy, but they often face financial challenges. Small businesses may need loans to cover operating expenses, purchase inventory, or invest in marketing and advertising.

These loans can provide small businesses with the funding they need to stay afloat and grow their business.

Growing Businesses

A growing business may need loans to fund expansion or investment opportunities. They may need to hire additional staff, invest in new equipment, or open a new location.

Business loans can provide a growing business with the capital they need to take advantage of these opportunities and continue to grow.

LLCs

Limited liability companies (LLCs) are a popular type of business structure that offers liability protection for owners. LLCs may need loans to cover startup costs, operating expenses, or expansion.

Business loans can be an excellent source of funding for LLCs, allowing them to achieve their business goals while protecting their personal assets.

Businesses Facing Unexpected Expenses or Emergencies

Unexpected expenses or emergencies can strike any business at any time. Businesses may need loans to cover the costs of unexpected repairs, legal fees, or other expenses that are not budgeted for.

Business loans can provide businesses with the capital they need to handle these unexpected expenses and continue to operate without interruption.

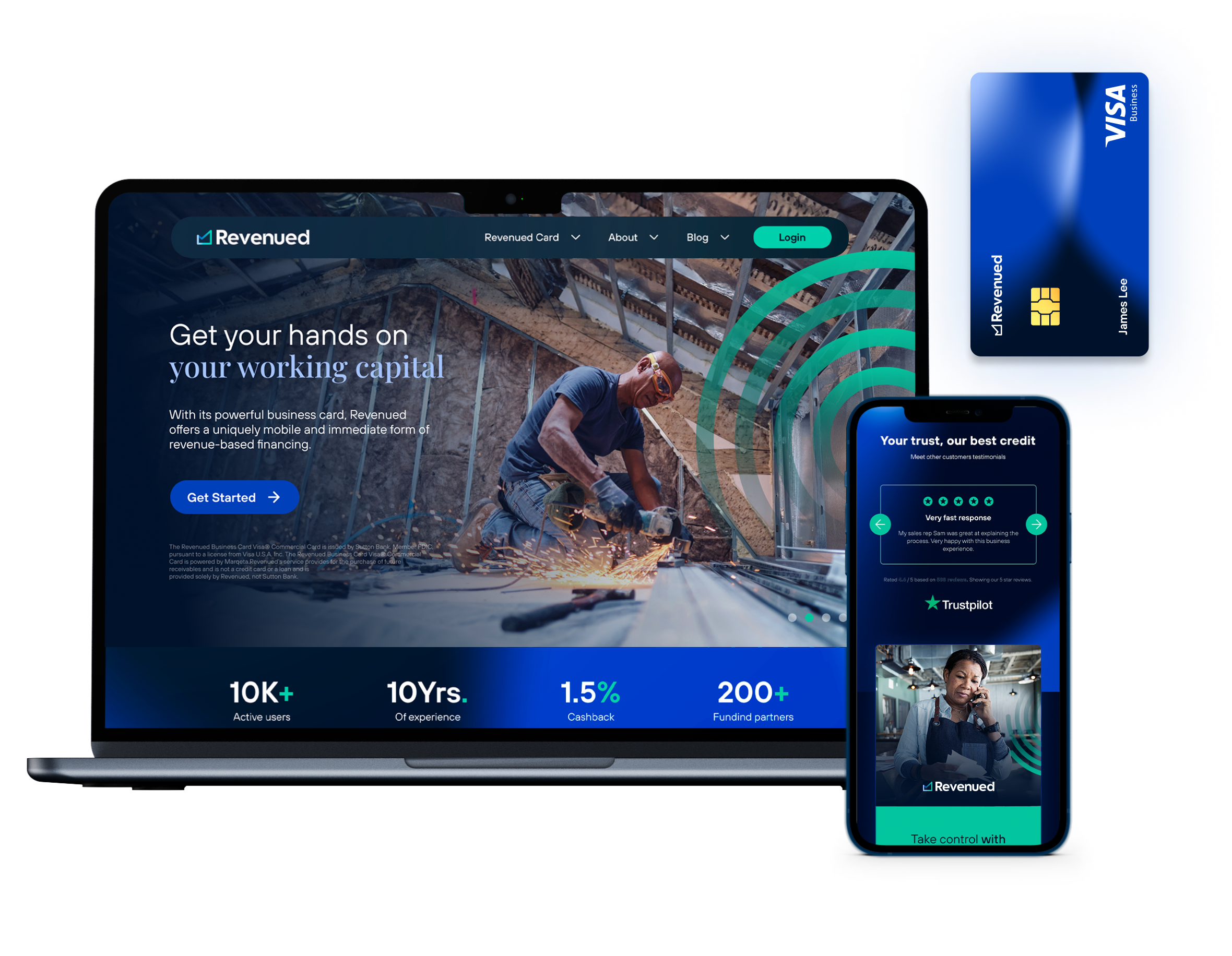

An Alternative to Business Loans: The Revenued Flex Line

If you need funding for your business quickly, a loan from a bank or traditional lender may not always be the best option. Revenued offers a Flex Line solution that uses revenue-based financing to provide flexible spending limits based on your business revenued – not your personal credit score. Revenue based financing is an investment not a loan. Revenued purchases a portion of your future receivables at a discount in exchange for providing working capital in the present. Because of this, receiving capital from Revenued can be much faster than borrowing from a bank.

The Revenued Flex Line vs. Business Loans

Revenue-based financing like the Revenued Flex Line operates differently from bank loans. Because the Revenued Flex Line is a purchase of future receivables and not a loan, it bases eligibility primarily on the revenue of the business itself instead of business owner’s personal credit score.

Unlike many other funding options like business loans, the Revenued Flex Line does not require a hard credit inquiry, so there is no temporary dip in the credit score of the business owner. Additionally, instead of one fixed funding amount from a business loan, the spending limit on the Flex Line increases in real-time as a business's revenue increases, making it a great option for businesses who are seeing rapid growth and need access to more funding for their operations. Although there are no draw fees or interest charges with the Revenued Flex Line, Revenued does charge a factor rate which may end up being more expensive than a conventional business loan. It’s important to weigh the pros and cons when making any financing decision for your business and if your personal credit score or timing are at the top of your list of deciding factors, the Revenued Flex Line can still be a great option to consider.

Read More About Business Loans

FAQs About Business Loans

There are several types of business loans available, including secured loans, unsecured loans, term loans, lines of credit, equipment loans, invoice financing, and SBA loans. Each type of loan has its own unique features and benefits.

Qualifying for a loan typically requires meeting certain criteria, such as having a strong minimum credit score and history, being in business for a certain amount of time, having sufficient annual revenue and profitability, and offering collateral or a solid business plan.

The amount that you can borrow with a business loan depends on various factors, including the type of loan, your credit score and history, and the lender's requirements. Typically, business loans can range from a few thousand dollars to several million dollars.