Resilience in Action:

What 2025 Taught America’s Small Business Owners

Executive Summary

Small business owners across the United States approached 2025 with persistence, caution

and a deep sense of responsibility to the people who depend on them. Throughout the year,

Revenued conducted multiple research studies, including the AI Usage Study, Q3 Tariff Report,

Tariff Ripple Report and our final Year-End Resilience Survey, to understand how small

businesses navigated economic volatility, shifting customer demand and tightening credit

conditions.

Taken together, these studies reveal that 2025 was defined not only by uncertainty, but by a

steady, practical resilience. Owners adjusted continually and quietly, making incremental

changes that kept many businesses operating through what they described as one of the most

unpredictable years in recent memory.

Core Themes From 2025

• Volatility shaped the year, with unpredictable revenue patterns, supplier delays and fluctuating demand.

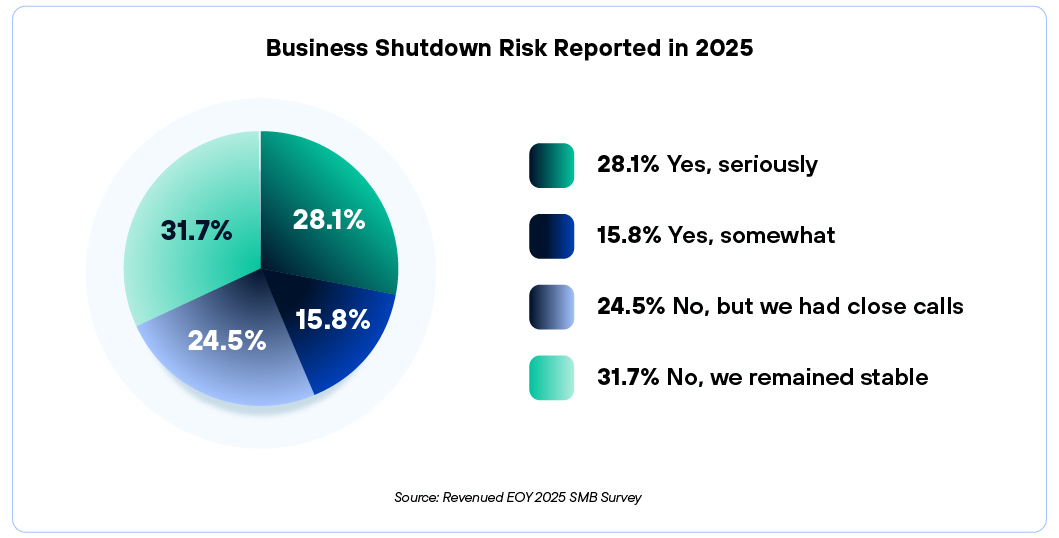

• Financial pressure intensified, with 68 percent of owners reporting at least one moment

when they feared their business might not make it.

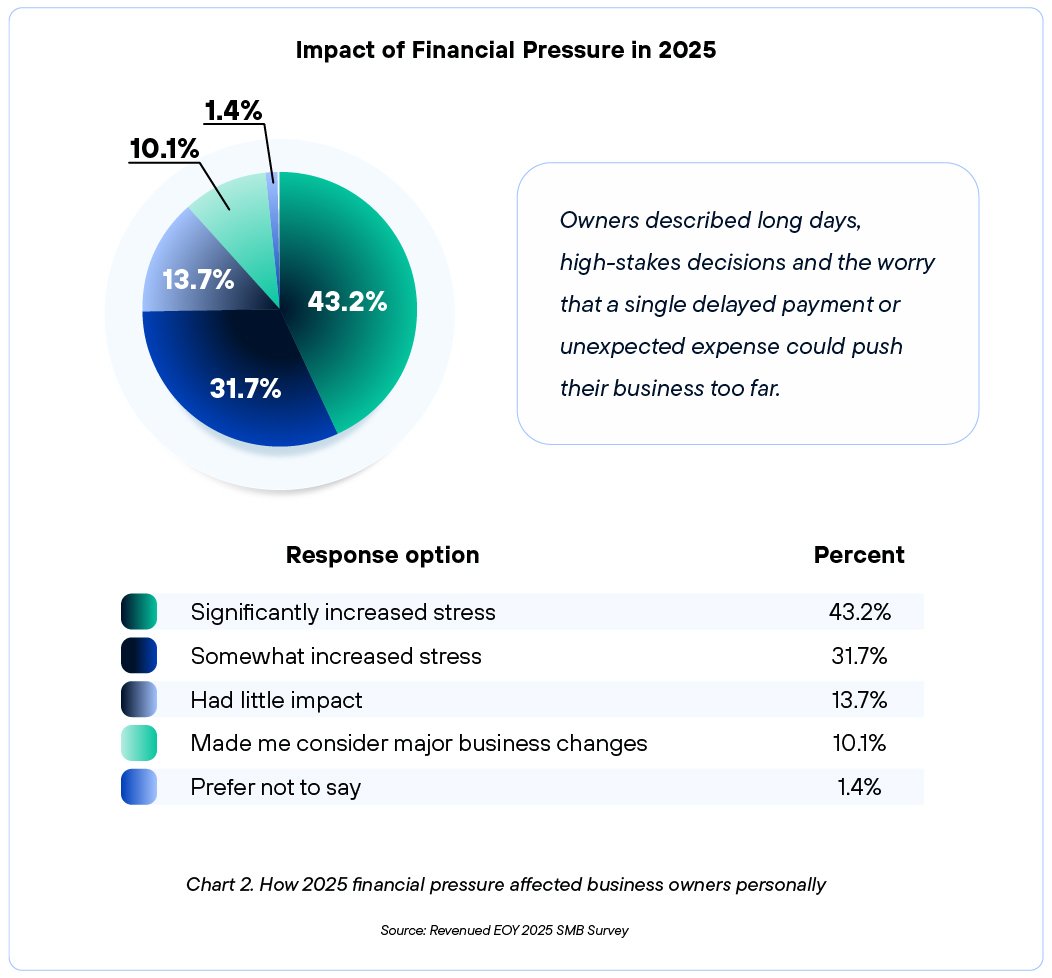

• Stress levels rose, with 43 percent saying financial pressure significantly increased their

personal stress.

• Operational adaptability became essential, from workflow redesigns to scaled-down

service offerings.

• Traditional financing often fell short, prompting many owners to look for faster and more

flexible alternatives.

• By year’s end, owners described themselves as more experienced, more grounded and

more prepared for whatever comes next.

Key Findings From the 2025 Year-EndSurvey

The Revenued Year-End Survey revealed a landscape marked by strain, adaptation and

determination. Volatility reached across industries, yet owners responded in ways that revealed

consistent patterns in both the numbers and the lived experiences behind them.

1. Financial Pressure Defined the Year

More than two-thirds of small business owners experienced at least one point in 2025 when

they feared their business might not survive.

2. Stress Levels Reached New Highs

Financial strain carried a personal cost.

• Forty-three percent of owners said financial pressure significantly increased their stress.

• Another third said it somewhat increased their stress.

Most owners experienced elevated strain.

3. Adaptability Became a Survival Strategy

Owners embraced small, frequent adjustments rather than dramatic overhauls. The goal was to

reduce unpredictability, protect cash flow and maintain customer trust.

Adjustments included:

• Restructuring service tiers

• Renegotiating supplier contracts

• Reducing operating hours or consolidating staff

• Using AI tools for administrative work

• Changing payment terms to stabilize cash flow

Many said financial pressure forced them to rethink how their business operated, whether

through pricing, workflows or cost structures.

4. Traditional Financing Fell Short

Owners frequently described a widening gap between the support they needed and what

banks delivered.

They pointed to:

• Approval timelines that clashed with urgent needs

• Qualification criteria that did not reflect volatile revenue

• Rigid repayment structures

• Financial tools designed for stability rather than real-world volatility

Angela, a renovation business owner in Virginia, said access to flexible funding “made the

hardest months survivable.”

A significant share of respondents reported turning to alternative financing at some point this

year, including revenue-based financing and other flexible options that aligned more closely

with their cash flow.

5. Resilience Strengthened Over Time

Despite ongoing pressure, many owners described entering 2026 with a grounded sense of

confidence. They said they were better prepared, had a clearer sense of what their businesses

could withstand and felt their experience, rather than market conditions, was carrying them

forward.

The Strain Beneath the Surface

Throughout 2025, owners from every industry described similar challenges, even if the

circumstances differed.

Tanya, who owns Little Steps Learning Center in Illinois, said she “felt the floor move more

than once” as enrollment shifted from week to week. Maya, founder of Orange Grove Creative

in Florida, said each month felt like “a different economy,” which made it difficult to plan ahead.

Omar, who operates Red Rock Construction in Arizona, described rewriting bids nearly every

week because supplier prices were changing faster than his team could adjust.

These individual accounts mirrored the broader dataset. Many owners reported moments of

genuine fear about their business’s future, and most said the financial strain of 2025 increased

their stress. Owners described long days, high-stakes decisions and the constant worry that a

single delayed payment or unexpected expense could push their business too far.

How Businesses Adapted When Conditions Kept Changing

Resilience in 2025 rarely looked dramatic. It looked quiet. It looked incremental. It looked like

owners making small adjustments that, taken together, kept their businesses open.

Renee, owner of Piedmont Custom Manufacturing in North Carolina, redesigned her workflow

to account for shipping delays and tariff-related price swings. “We stopped assuming

anything would arrive on time,” she said.

Angela, who owns Tidewater Renovation and Design in Virginia, created a smaller service tier

for customers who were nervous about committing to larger projects. The offering did not

increase revenue immediately, but it kept her business active during unpredictable stretches.

Marcus, who runs Lakeside Auto Service in Michigan, renegotiated supplier contracts,

updated his pricing structure and made changes that helped protect his cash flow. “I needed

something that matched how my business actually runs,” he said.

Many owners also turned to technology. Some adopted AI tools to complete time-consuming

administrative tasks. Others relied on digital invoicing, scheduling platforms and automated

customer-communication systems to reduce the burden on already stretched teams.

These adjustments varied, but they shared a purpose. Owners were trying to bring stability to

systems that no longer behaved predictably.

The Limits of Traditional Support and the Search for Flexibility

One of the clearest findings of the year was the widening gap between what owners needed

and what traditional financing provided.

Owners often pointed to approval timelines that were too slow, criteria that failed to reflect

real-world revenue patterns and repayment structures that did not adjust when business

softened. Several described bank tools that felt designed for a steady environment, not for the

shifting landscape they operated in.

A significant number of survey respondents reported turning to nontraditional or flexible

financing options during the year, including revenue-based financing that aligned with cash

flow rather than fixed monthly payments.

Angela, the renovation owner in Virginia, said this flexibility “made the hardest months

survivable.”

Jake Lerner, Chief Revenue Officer at Revenued, saw the trend across industries. “The

businesses we spoke with were not looking for special exceptions,” he said. “They were

looking for financial tools that reflect how their businesses actually work.”

The Human Perspective From Interviews

Survey data revealed the scale of small business challenges in 2025. Interviews revealed their

emotional depth.

Elona Bregasi, who led many of these conversations, said owners often spoke about

exhaustion, but her strongest impression was their sense of responsibility. “They described

showing up for their teams, their customers and their families, even when things were

difficult,” she said. “There was a determination that did not always show up in the numbers,

but it came through clearly in their voices.”

This human dimension helps explain why many owners said they felt more prepared for 2026,

even though most expected another challenging year. They were not becoming more

optimistic. They were becoming more experienced.

When asked about the new year, owners did not describe optimism. They described

perspective.

Tanya, the childcare provider in Illinois, said she now understands what her business can

withstand. Maya, the marketing consultant in Florida, said she enters 2026 “more realistic but

more confident.” Others echoed the same mix of caution and earned clarity.

Grant Pastor, Director of Marketing and Research at Revenued, saw the same pattern

reflected in the data. “What stood out most was the resolve,” he said. “People were pushed

into difficult situations and still found ways to move forward. This was not blind positivity. It was

confidence shaped by experience.”

These insights set the tone for how owners are approaching 2026.

How Owners Are Approaching 2026

The final phase of Revenued’s Year in Review research asked business owners how the close

of 2025 was shaping their expectations for the year ahead. Their responses revealed a

community that feels stretched, resourceful and increasingly practiced in navigating volatility.

1. Financial Pressure Carried Into the New Year

Many owners said financial pressure increased as 2025 ended, citing rising costs, inconsistent

demand and slower payments. Only a small number reported any relief.

"Many owners said financial pressure increased heading into 2026. This finding reinforces a broader theme: the unpredictability of 2025 did not fade toward year-end. It accumulated."

2. Cash Flow Is the Central Concern for 2026

When owners identified their biggest challenge for the year ahead, cash flow dominated.

Owners described:

• unpredictable payment cycles

• tighter access to capital

• rising supplier and operating costs

• difficulty building reserve funds

• uneven seasonal or regional demand

“Cash flow became the whole game this year,” said Jordan, who runs a retail business in Ohio.

Other concerns included customer demand, labor costs and inflation, but none appeared as

frequently as cash flow.

3. More Owners Turned to Tools and AI for Efficiency

The adoption of new tools and technology increased throughout the year. Owners said this

shift was driven by necessity rather than curiosity.

Examples included:

• automated scheduling

• invoicing and payment reminders

• AI assistants for paperwork and communication

• inventory tracking

• follow-up tools for customers

Many respondents said these tools helped them manage time more effectively, and several

indicated that they will play a larger role in 2026.

4. Despite the Pressure, Many Owners Feel Prepared for 2026

Most respondents described themselves as at least somewhat prepared for 2026. That

preparedness did not come from improved conditions, but from the adjustments they made

throughout the year.

Several owners said they now have a more realistic understanding of what their business can

handle, even if they expect another difficult year.

Owner Profiles From the 2025 Year in Review

Jordan (Retail, Ohio)

“Cash flow became the whole game this year.”

Jordan described erratic customer behavior and rising supplier costs that made planning nearly impossible. He enters 2026 focused on building a more consistent cash buffer.

Celeste (Consulting, California)

Celeste described unpredictable client payments and a growing administrative workload. She turned to digital tools to stay organized and said she feels “prepared but watchful” heading into the new year.

Malik (Transportation, Georgia)

Malik pointed to increased fuel and maintenance costs, paired with late payments. He adopted new invoicing and scheduling tools and expects 2026 to be demanding but manageable.

Denise (Hospitality, Pennsylvania)

Denise saw fluctuating customer demand and staffing challenges throughout the year. Rising food and supply costs narrowed her margins. She remains cautiously optimistic but expects pressure to continue.

What 2025 Taught Small Business Owners

The final responses of 2025 reveal a small business community entering the new year with realism and earned confidence. Owners expect unpredictability. They anticipate financial

pressure. They do not count on sudden demand stability. Yet many feel ready to navigate what

comes next.

They said:

• they now understand what their businesses can withstand

• they plan to rely on the adjustments they made in 2025

• flexibility and speed will matter more than long-range planning

• they expect swings in demand and cost to continue

“I am not expecting next year to be easier. I am just more prepared for how hard it might be,”

said Denise, the hospitality owner from Pennsylvania.

Cash flow will continue to shape strategy. Technology will continue to save time. Traditional

financing gaps will matter. And resilience will remain the mindset that defines small business

operations in 2026.

A large share of respondents described themselves as prepared for the new year.

Preparedness does not necessarily reflect optimism. It reflects confidence shaped by

experience.

Many owners said they are entering 2026 more prepared than ever

Editor’s Note

This report draws on research surveys and interviews conducted throughout 2025 by the

Revenued team, led by Grant Pastor and Elona Bregasi. Some names and identifying details

have been changed to protect privacy. Quotes have been lightly edited for clarity.

Save the full report here

Discover the insights, data, and real stories behind how small businesses are staying resilient in a changing economy.

Resilience in Action: What 2025 Taught America’s Small Business Owner

Download the Free PDF

Enter your email below to receive our latest report on AI usage among small businesses.