The Tariff Ripple:

How Small Businesses Are Adapting to Rising Costs in 2025

Introduction

As 2025 winds down, small business owners across the country are facing a holiday season unlike any other. Inventory is on the shelves, customers are shopping, but behind the scenes, many are quietly recalculating what it takes to stay afloat.

Tariffs that were expected to be temporary have instead stretched into another quarter, reshaping supply chains and forcing small businesses to make tough choices about pricing, staffing, and investment. For some, it’s a test of endurance. For others, it’s a lesson in resilience.

This quarter, The Revenued State of Small Business Report surveyed more than 100 business

owners across retail, construction, wholesale, and manufacturing to understand how tariffs are

changing their bottom line. The results paint a familiar but intensifying picture: costs are up,

confidence is mixed, and adaptation has become the new business model.

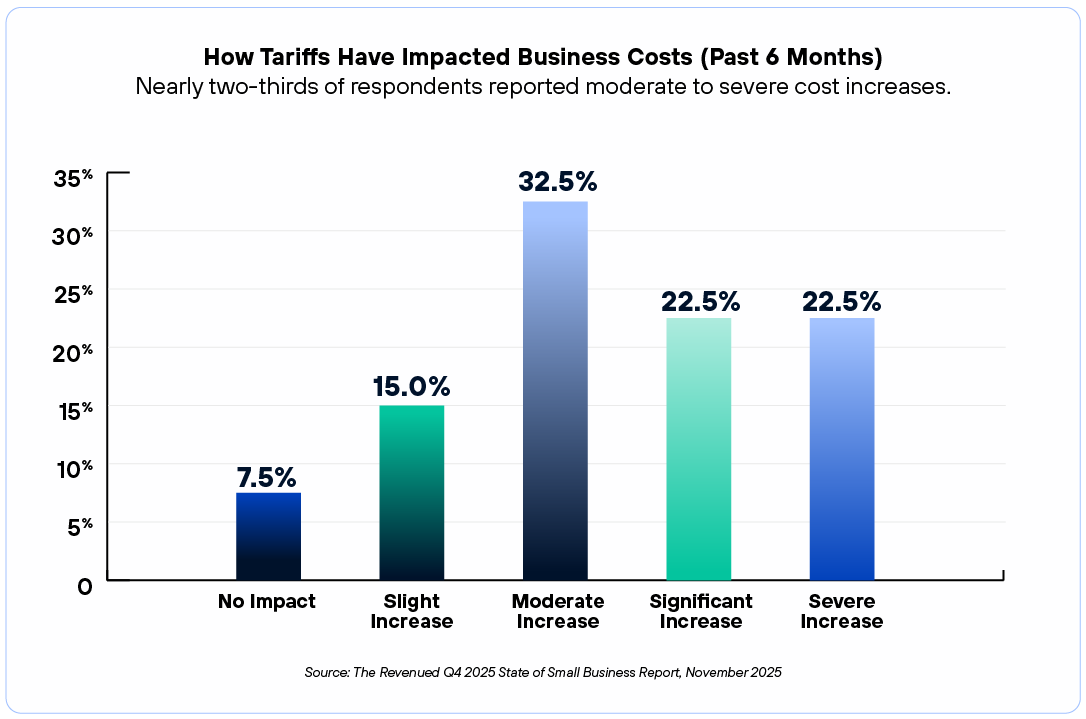

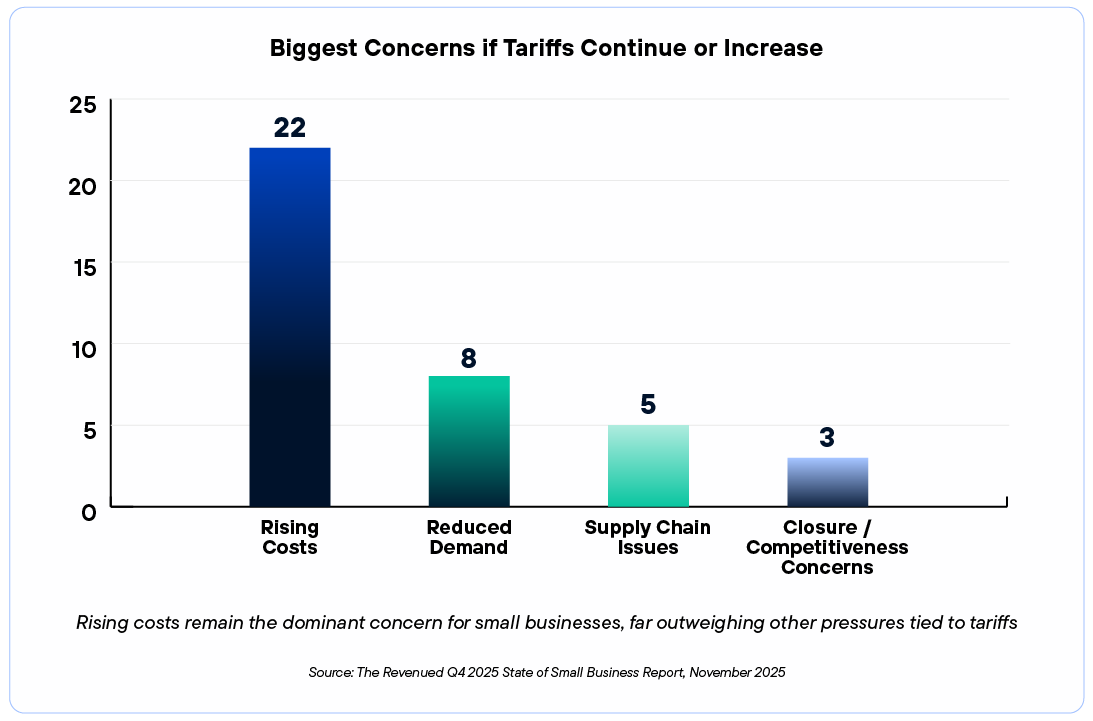

The Cost Squeeze

Nearly eight in ten business owners say tariffs have raised their operating costs over the past six months, a steady climb from earlier this year. Retailers and construction companies reported the sharpest increases, particularly those dependent on imported goods, materials,

or equipment.

Neil R., Contractor, Miami, FL

“Every month it feels like something else goes up—materials, equipment, freight. We’re

constantly adjusting.”

.png)

Retail and construction businesses make up the majority of respondents, reflecting where

tariff pressures are most acute.

As costs rise, most owners say they’ve had no choice but to raise prices. But those increases

aren’t keeping pace with inflation or shipping surcharges.

Daniel W. CRP Racing, Pennsylvania.

“We raised prices twice this year and customers still feel it, at some point, you just can’t pass on any more.”

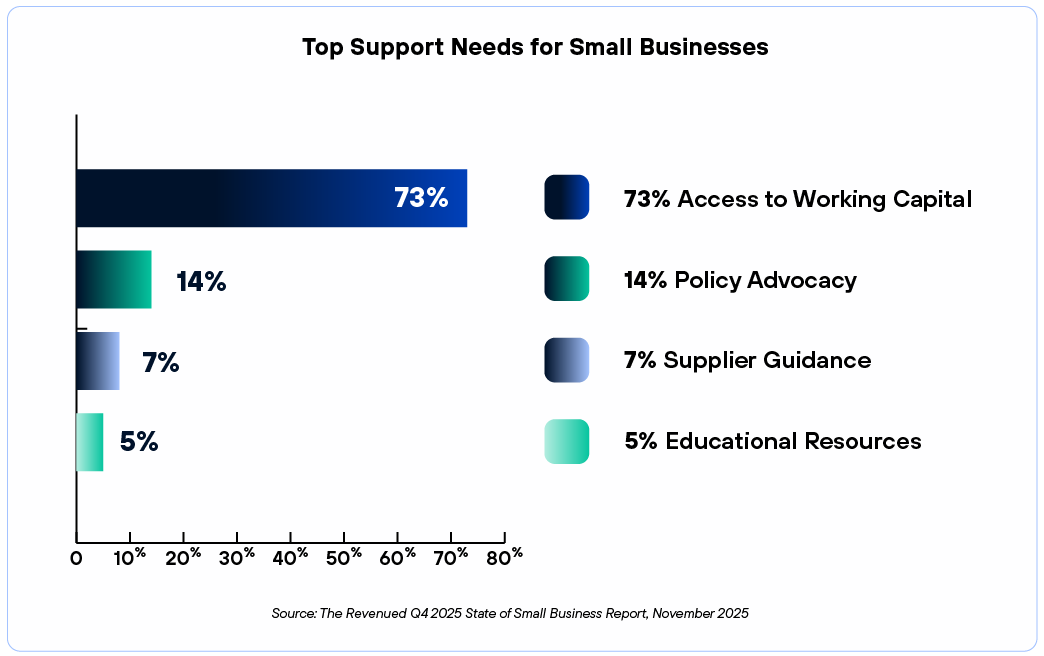

Cash Flow and Confidence

While costs dominate headlines, cash flow tells the deeper story. Access to working capital remains the single biggest factor in whether a business can survive prolonged volatility. Three in four respondents named it as their most critical need this quarter, the same top answer as in Q3.

Michael T. of TruEdge Construction (Atlanta)

“Cash flow is everything right now. Without quick funding options, we'd be stuck waiting for payments to catch up."

DeShawn K. of K&B Logistics (Houston)

"We’ve stopped relying on overseas parts completely. Local sourcing costs more, but it’s more predictable. That stability is worth paying for."

The Human Side of Tariffs

Behind the numbers are stories of adaptation and fatigue. “It’s hard to plan when every quote from suppliers keeps changing,” said Lauren G., owner of Cedar & Co. Home Goods in Portland. “We used to order a season ahead, now we’re just trying to keep the shelves stocked.”

In our open-ended survey responses, small business owners spoke about the emotional toll of volatility—from negotiating with suppliers to explaining price changes to loyal customers. Many said they’ve learned to operate on slimmer margins, manage smaller inventories, and

rely more on digital tools to forecast and budget.

Supply chain delays continue to frustrate operations, even as shipping times improve. More than half of respondents said they’ve experienced shortages or delivery disruptions in the

past six months. A growing number are shifting suppliers or sourcing domestically to regain

control.

“We used to order from two overseas vendors,” said Rachel S., owner of Brightline

Manufacturing in Cleveland. “Now we buy locally, even if it means higher prices—at least we

can predict when materials will arrive.”

Tara P. of Brightline Manufacturing

"The further you are from raw materials, the worse tariffs hit. Small companies don’t have the buffers big corporations do."

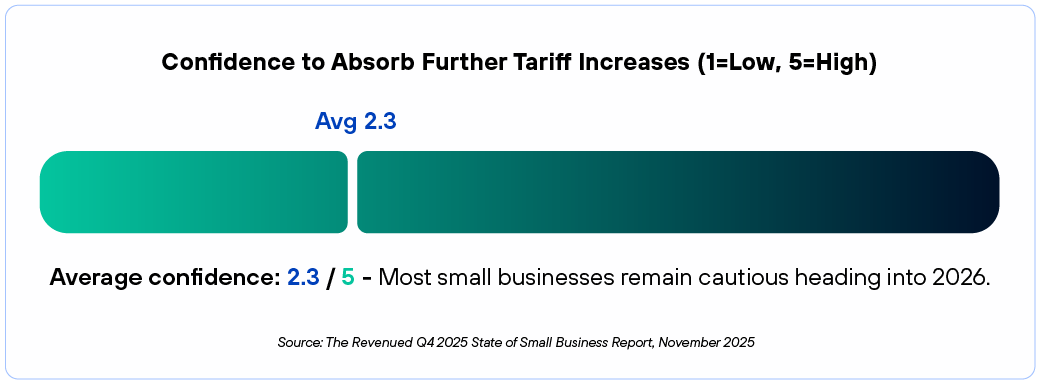

Resilience Under Pressure

Despite the challenges, this report captures something more enduring: the resilience of small

business owners in a difficult economy.

Even as costs rise, confidence wavers, and supply chains strain, most are still pushing forward.

They’re adjusting, rethinking, and surviving—one customer, one invoice, one pivot at a time.

“It’s not easy, but we’ve built this far—we’re not giving up now;” said Carlos M. of All Seasons

Imports in Tampa.

Revenued’s Take

The results of this quarter’s State of Small Business Report reinforce what we’ve seen

throughout 2025: small business owners are operating in an economy that rewards agility, not

size. The ability to pivot, plan, and protect cash flow has become as important as revenue

growth itself.

At Revenued, we believe that understanding the lived experiences behind these numbers is critical. Tariffs, inflation, and cost pressures are economic realities, but the entrepreneurial

response to them is what defines the small business landscape.

We’ll continue tracking how these pressures shape decision-making and providing revenue based funding solutions designed for flexibility—because resilience isn’t just a story; it’s a strategy.

This report was developed and written under the direction of Grant Pastor, with Elona Bregasi contributing research and editorial collaboration, and creative direction and production by the Revenued marketing team.

Survey data was collected in November 2025 as part of the Revenued Q4 2025 State of Small Business Report. Quotes in this report represent sentiments shared by survey respondents and are anonymized for privacy unless otherwise noted.

Save the full report here

Discover the insights, data, and real stories behind how small businesses are staying resilient in a changing economy.

The Tariff Ripple: How Small Businesses Are Adapting to Rising Costs in 2025

Download the Free PDF

Enter your email below to receive our latest report on AI usage among small businesses.